What happens in Vegas does not always stay in Vegas

5 Apr

The Eurozone will need a better functioning labor market to keep the monetary union

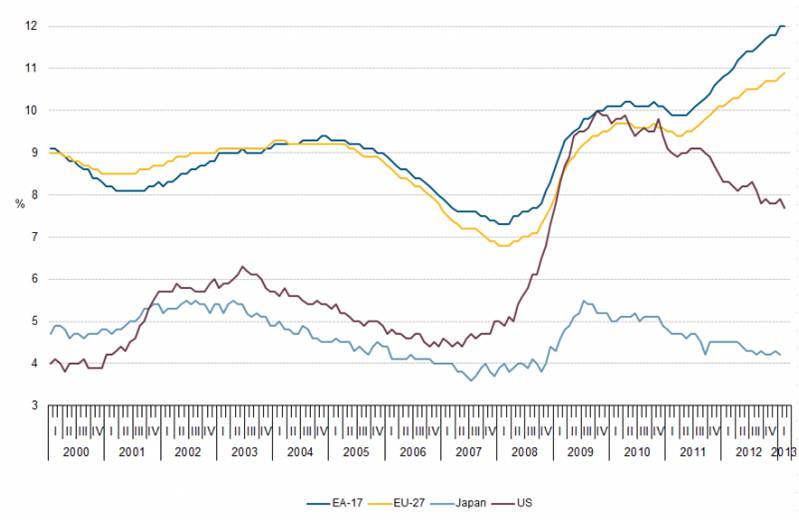

Unemployment in the Eurozone is at 12%, and the dismal short-term activity and sentiment indicators point to a likely further rise. In the meantime, the unemployment rate in the US is on a downward trend (even if it is still relatively high, compared to historical values). This is interesting because things looked very different back around mid-2009. At that point, which turned out to be the trough of the first phase of the Great Recession, employment had been declining significantly faster in the US than in the Eurozone. By Q3, 2009, US employment was down by 6% from its peak, Eurozone employment by 2.5%. And the US unemployment rate, which has always been significantly lower than in Europe, had reached the Eurozone level at that time (see chart below).

EU-US divergence…Seasonally adjusted unemployment rates

Sources: Eurostat

Sources: Eurostat

But then the same old pattern seems to be coming back. The unemployment rate difference between the Eurozone and the US now is as wide, or even wider, than usual (about 4-5 percentage points), three and a half years after being the same. Employment in the US is still down from the peak, but only by 2%. In the Eurozone, employment has continued to decline, and now is probably down by more than 3% from the peak (we only have Q3 2012 Eurostat data).

There are several reasons for this:

- The US was able to conduct looser monetary and fiscal policies (this may come back to haunt it though in some form in the future, probably in the shape of increasing inflation)

- The US has better functioning and more flexible labor markets: it is easier to fire people than in Europe, but companies are less afraid to re-hire workers in an upturn. Also, labor mobility is higher than in Europe

- Bank lending in the US plays a lesser role (the corporate bond market is more important than in Europe), and large banks operate nationwide, not tied to any particular state. This means that in some parts of Europe, bank lending and thus economic activity can suffer exactly when the given country suffers an economic/asset price setback.

- The federal state is much larger in the US than in the Eurozone (EU), and can play a countercyclical role. It pays unemployment benefits even if state governments go bankrupt

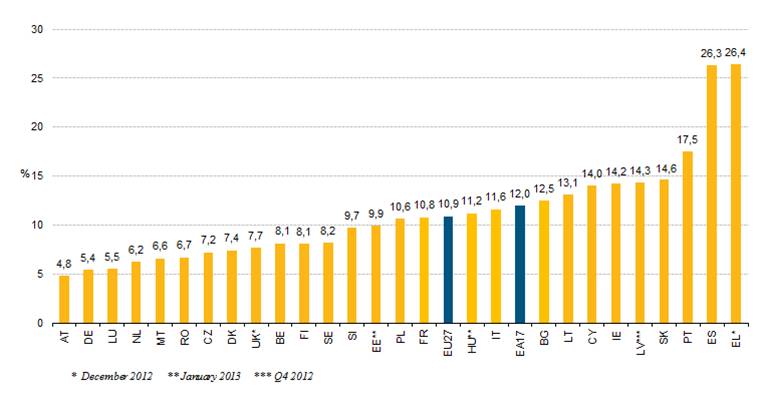

It is also worth taking a look at the country level unemployment rates:

Source: Eurostat

Source: Eurostat

The US (since the Great Depression) never had an unemployment rate in any state as crazy as Spain or Greece currently have (above 25%). In February, the highest unemployment rate in the US was in California, at 9.6%, and the lowest in North Dakota, at 3.3% (remember the shale gas boom we wrote about?).

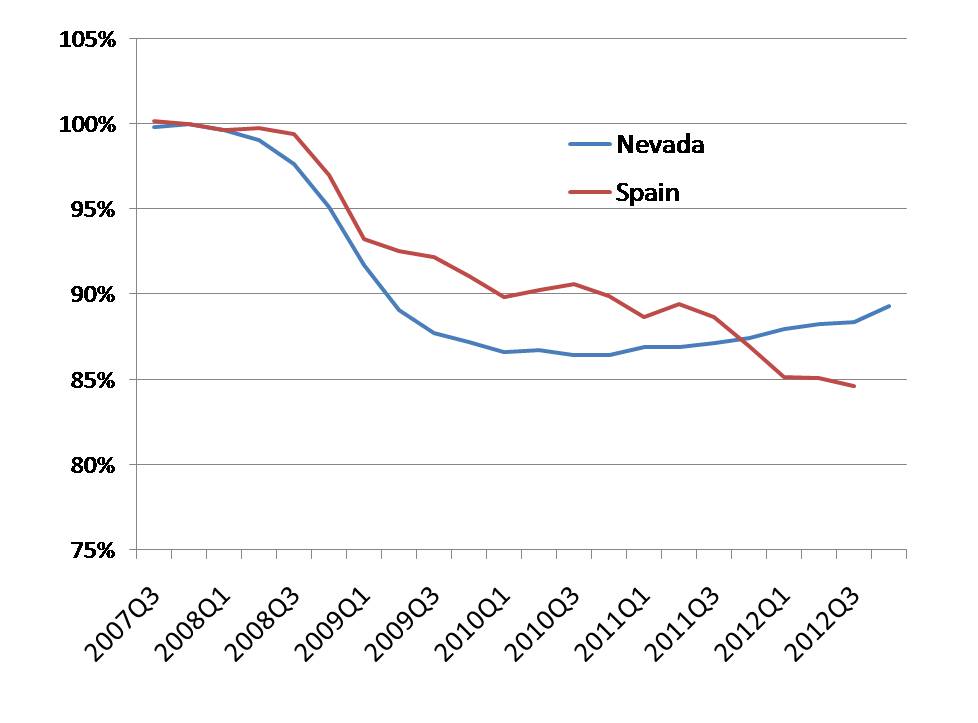

Let’s take two specific examples to see the difference in the adjustment process. Hot, with a property boom that went bust and containing a lot of Spanish speaking people – that describes both Spain and Nevada. The decline in employment initially was much the same (in fact, the cumulative employment decline was smaller in Spain than in Nevada up to 2012, see chart below)

Two very similar busts…Employment, Q42007=100

Sources: Eurostat, BLS

Sources: Eurostat, BLS

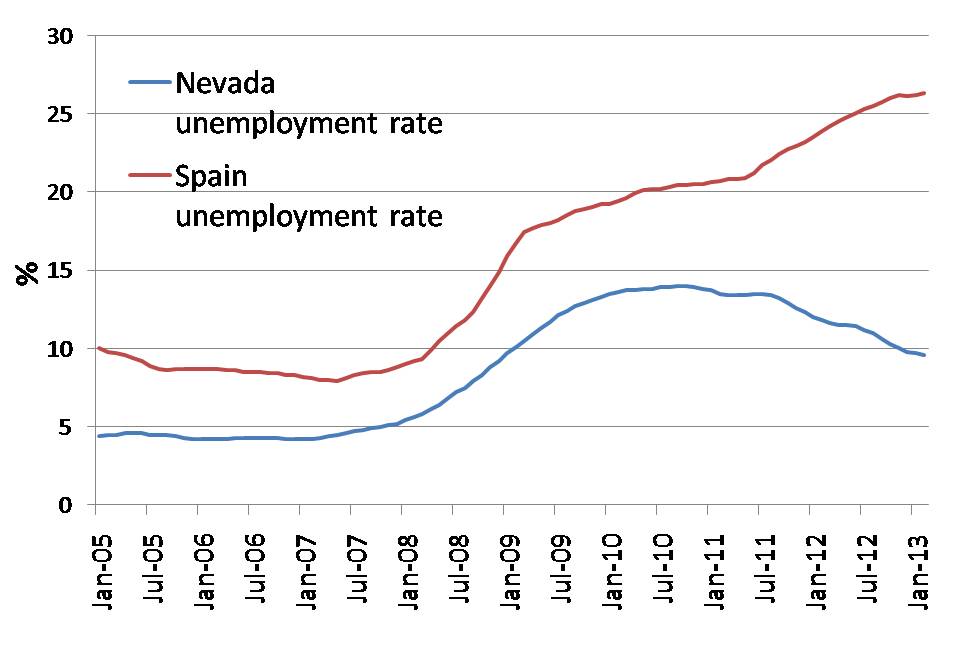

The unemployment response was very different. In Spain, employment declines went straight into unemployment rates, and stayed there. In Nevada, as time went on, part of the unemployed population migrated to other, more prosperous states. Unemployment rates peaked at 14% in Nevada in 2010, and is now 9.6%. The decline in the labor force was equivalent of about 40% of the decline in the number of unemployed. What happens in Vegas does not always stay in Vegas.

…but two very different unemployment response

Source: Eurostat, BLS

Source: Eurostat, BLS

In Europe, the labor migration response is a lot less intense than in the US (except maybe from Central and Eastern Europe, where lower relative income levels are an additional motivation). You need a huge shock to move people away from their familiar language, environment, friends and families. Greek and Spanish workers have started to move to places like Germany, but only after unemployment levels reached astronomical levels (for young people they are above 50% in both countries). However, more prosperous EU countries such as the UK or Germany may introduce measures curtailing migration in light of the crisis. Most recently, for example, the Cameron government announced plans to clamp down on welfare benefits for migrants.

In the Eurozone, most politicians now came to the conclusion that if they want to maintain a common currency, they need to have a common fiscal policy. That may be necessary, but not sufficient. A common and well functioning labor market may be necessary as well.

If you liked the post, follow the Rolling barrel blog on Facebook!

Or subscribe to our newsletter!

If you liked the post, follow Barrelperday on Facebook!

Or subscribe to our Twitter feed or Newsletter

Tags: EU, Eurozone, labor market, USA

No comments yet