The demise of the Central Banker for oil…

11 Apr

…which would also bring down OPEC

![]()

There was an interesting piece from Nick Butler in the FT on whether Saudi Arabia can export enough to maintain sufficient revenues underpinning social peace in the face of growing domestic oil consumption and the potential need to cut oil exports to maintain prices. In this post we would like to concentrate on the second issue, a theme we have already touched upon: Could Saudi Arabia cut exports if that is necessary to maintain high current oil prices? And will that need arise? The answers are No and Yes, respectively: Saudis will not be able to cut exports, despite a need to do so. The only question is when this will happen.

Unpleasant Saudi fiscal realities…

Countries in the Arab Spring that did not have enough oil revenues faced a revolution. Those that had enough revenues, postponed it by spending more. Saudi Arabia was in the second camp. Fiscal spending has been increasing 12% per annum over the past 10 years. This means that the breakeven oil price, which is needed for the country to balance its budget, has increased from around USD 30/bbl to maybe about USD 80/bbl. (See a list of breakeven prices for various OPEC countries from Deutsche Bank here). Of course these numbers are highly uncertain, as fiscal spending is hardly transparent in OPEC countries. More importantly, the breakeven price depends on how much oil is exported, which fluctuates, as the Saudis try to balance the oil market, playing its central banker. But from the USD 80/bbl figure we could calculate (roughly) how much room the country has to cut exports to maintain the same spending at current oil prices and not to run a fiscal deficit. That is about 2 mbpd for Saudi Arabia currently. But it is likely to disappear over time.

…and demographics will increase pressure further

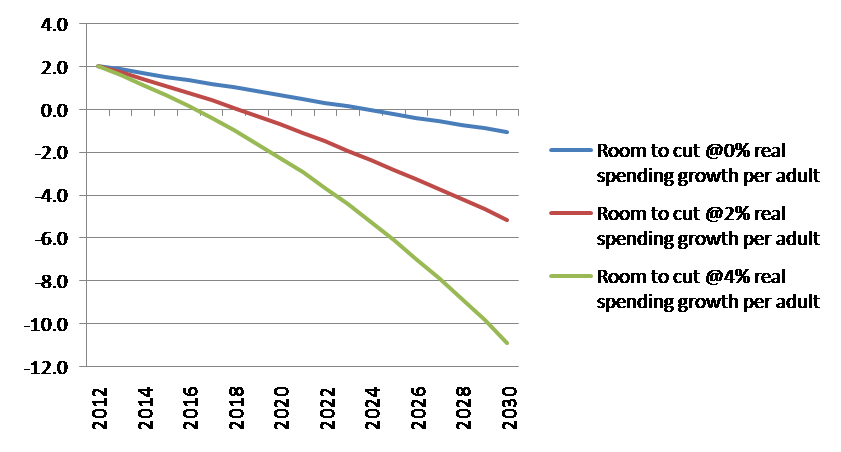

The Saudi population has been growing at more than 2% per year, and the adult population, which may be the more relevant metric (these are the people who need to be bought out in some form), has been increasing at around 3% per year. To keep these adults happy, you probably even need to increase their real incomes at some perceptible pace, since people quickly get accustomed to a certain standard of living. But even if you don’t do that, the sheer increase in their numbers will, other things equal, increase the needed breakeven oil price, and reduce the ability of Saudi Arabia to cut exports to support oil prices. The following chart shows different scenarios of fiscal spending growth per adult population, and how much “room to cut” oil exports Saudi Arabia has. Even with zero real government spending growth per adult population, the ability to cut production would completely disappear by the early 2020s (because of the increase in population) – assuming current real oil prices.

Disappearing room to maneuver: Saudi production cut possibility without running a deficit

Source: Own calculations, BP, UN population data

This time is different…

The above discussion implicitly assumed that Saudi Arabia politically cannot cut (or even needs to increase) government spending to maintain social peace. The usual objection to this is that the Kingdom was able to cut production and exports massively in the past, and could withstand a substantial reduction of export revenues. For example, it cut net exports from 9.7 million barrels per day (mbpd) to 2.6 mbpd between 1980 and 1985, according to BP’s data. Currently net exports are around 8.6 mbpd; surely it could afford to cut more than 2 mbpd if needed? In short, no, at least not in a sustained manner. It is interesting to compare the present to the early 1980s:

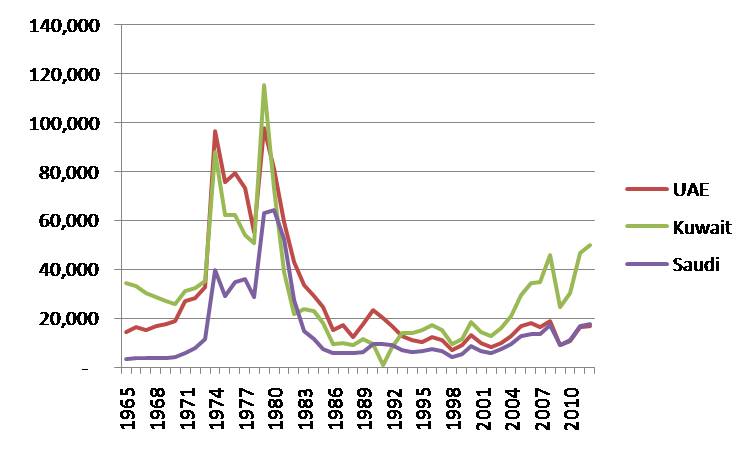

- The population was a lot smaller(less than 6 million adults, compared to more than 20 million today), and therefore oil revenue per adult was much higher in the past (see chart below). Popular imagination still has Saudi Arabia as this unimaginably rich oil state. In fact, currently its GDP per capita is about the same as Slovakia’s (in PPP terms). Oil revenues are below USD 20,000 per adult. In 1980, they were above USD 60,000 in current dollars.

- In the early 1980s, the experience of oil wealth was relatively recent after the price and production jump of the 1970s. The country did not get fully used to it. The royal family wasted a big chunk of the revenue, and it did not trickle down to the general population to the same extent as it has by now, so the broad entitlement culture did not have time to build up yet.

- Even with these advantages in the past, Saudi Arabia came close to default by the late 1990s. Currently, it has huge assets abroad (around USD 650 bn, or about two years’ worth of oil export revenues), which would give it some leeway. But this is far from unlimited.

Oil revenues per adult, 2012 dollars: not what it used to be…

Sources: BP, OMR, UN, own calculations

Sources: BP, OMR, UN, own calculations

It all comes down to the human factor, but there is a palpable tension and desire for change in the Kingdom. We reckon that as time goes by, Saudi Arabia will be less and less able to afford to cut exports, and even with increased spending it may face social unrest.

… or is it just history repeating itself?

The history of the 1980s shows that Saudi Arabia can sometimes lose control of the oil market. Back then, it tried to balance the market for a while, by reducing its output. But by 1985 it became fed up with other OPEC members cheating and free-riding on its production cuts, and suddenly flushed the market with oil, causing a price collapse. And indirectly contributed to the collapse of the Soviet Union as well, but that is a different story.

Then… Source: http://biega.com/photoalbum/

Source: http://biega.com/photoalbum/

Turning back to today’s situation, there are smaller OPEC oil producers like Kuwait and the UAE that have a history of cutting oil production to some extent to stabilize prices (other OPEC members typically pump as much as they can). But they face similar problems, and in the past they were not willing to be the swing producer to the same extent that Saudi was, partly because they are smaller compared to the global oil market.

So OPEC is really Saudi Arabia… If Saudi Arabia loses control, so does OPEC. Ultimately, this is the real Catch-22 of OPEC: oil exporters require higher prices to balance their budgets (and to buy off their populations). However, high prices will decrease global demand and increase supply, undermining their market power. It also encourages innovation: the unconventional boom that has already altered the natural gas scene now appears to move on to oil.

But would there need to be a cut in Saudi production to stabilize oil prices? As we already hinted at the beginning of the post, the answer is yes. Let’s return to this question in our follow-up post…

..and now Source:www.gtspirit.com

Source:www.gtspirit.com

If you liked the post, follow the Rolling barrel blog on Facebook!

Or subscribe to our newsletter!

If you liked the post, follow Barrelperday on Facebook!

Or subscribe to our Twitter feed or Newsletter

Tags: budget, MidEast, oil, Saudi Arabia

No comments yet