The end of ever increasing oil prices

30 Apr

We could well see oil prices spike to new records. But the average price in the next decade is likely to be lower than in recent years.

In our previous piece we have shown that Saudi Arabia may not be able to cut production to stabilize oil prices much longer, if needed. In this post we are going to show that this would likely be needed to maintain oil prices.

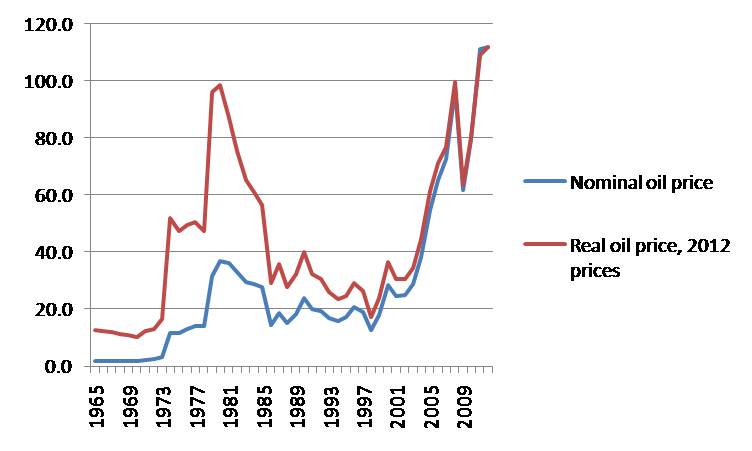

Here’s a concise history of recent oil prices: Rapid economic and oil demand growth in emerging markets gradually pushed up prices from the mid-2000s. Expensive oil eventually contributed to the 2008 global financial crisis. This cut back both demand and prices. But in the subsequent recovery relatively high (around $105-110/bbl) oil prices became the norm. The longer term supply and demand response to high prices is just unfolding.

Real oil prices at record highs

Source: BP

Source: BP

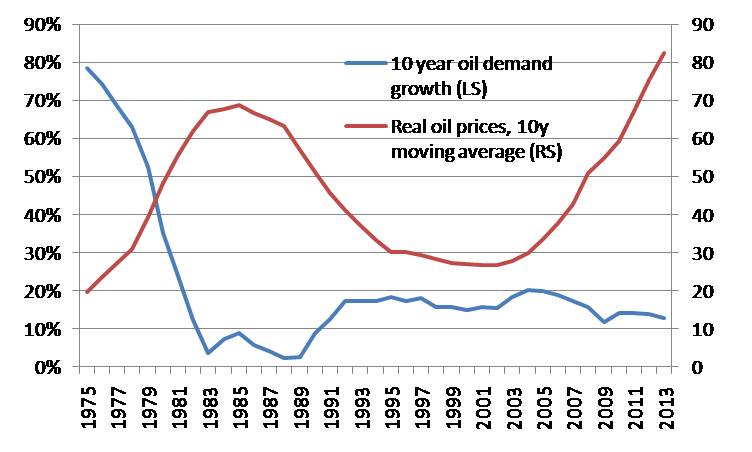

Boring but true: demand growth slows when prices are high

On the demand side, there is a significant slowdown since prices have been high. Average annual demand growth is at around 0.8 mbpd (or a bit less than 1%) since 2005, when the yearly average price went above $60 in today’s dollars. Sometimes the story is told in a way that demand growth is higher in “non-recession years”. That is a mistake. Recessions and sluggish GDP growth are an integral part of the package: the sustainable growth rate is lower than previously seemed, and the sustainable oil demand growth will therefore be lower as well. Part of the reason growth is slow is that the oil price is high. To filter out the cyclical noise, let’s have a look at both oil demand growth and real oil prices averaged over the previous decade (see chart below). Oil demand growth is slowing, and once the very strong 2004 falls out of the index, the average will be below 10% per decade. That is not what most forecasters assume for the future: a typical forecast is a 1.5 mbpd increase yearly, which adds up to 17% over the next decade.

Can you spot the pattern? Demand slows when prices are high…

Source: BP, OMR, own calculations

Source: BP, OMR, own calculations

What is more, cheap gas is a very recent phenomenon, and it has just started to replace oil in transportation. LNG and CNG are gaining ground, especially in China and the US. Future growth rates can easily be weaker than in the past 10 years. Citibank goes as far as predicting that peak oil demand is near.

The unconventional oil revolution is just beginning

Adjustment on the supply side takes time as well, much longer than many previously thought. But it is happening, at last: more expensive prospects like Arctic and deep offshore ones are being pursued, and there is a learning process which may make them cheaper in the long run. But a more important new development is unconventional (shale) oil. Unconventional gas is an old hat by now, while shale oil appeared on the radar screen in the US only in recent years, and the breakthrough apparently came in 2012. It has been growing fast. Now the consensus is that North American oil production could increase by about 1 mbpd (and this could be easily more) in each of the next few years, mainly because of the rise of unconventional oil. The US may well be the largest oil producer in the world by the early 2020s.

Unconventional oil may be easier to export to outside of the US than unconventional gas: the end-product is more valuable and it is easier to transport; this is possible even if there is no dedicated infrastructure. Everyone is after it, from China to Latin America. But even traditional producers (like Russia for example) are highly interested. Russia has unconventional oil resources that could be many times bigger than those of the US.

These are early days, but if unconventional gas is anything to go by, the production of unconventional oil may surprise on the upside.

Do the math: “call” on OPEC to shrink

Currently global “liquids” consumption (which includes crude oil plus natural gas liquids (aka NGLs) and biofuels) is about 90 mbpd (which is roughly 5 cubic kilometer per year by the way). If we are bullish about demand, this is going to increase by 1 mbpd a year. Non-OPEC production is likely to increase by 1.5 mbpd – remember, just North America is likely to account for 1 mbpd or more from this, and it could be an underestimation in the longer run, due to unconventional oil. There is likely to be some increase in biofuels, gas to liquid (GTL) technologies and so on, but let’s disregard those. Even then, the “call” on OPEC, as it is called in the jargon, would shrink by 0.5 mbpd each year on average. OPEC will probably have to cut production by this amount on average each year to maintain roughly the current price level. On this arithmetic, by 2020 OPEC would need to cut by roughly 3 mbpd. By that time, politically it will not be able to cut anything.

New Springs to come

As we have shown in our previous piece, OPEC practically means Saudi Arabia. And that in a few years it will not be able to afford a sustained production cut at all (beyond a temporary setback). And it is not just non-OPEC countries that will increase production. Some OPEC producers are also likely to do that, which would further increase the need for production cuts from Saudi Arabia. Iraq’s official plans point to a huge 10 mbpd additional production by 2020, though around 2 mbpd seems more likely. If Iran ever comes out of its embargo, it could also boost production significantly – 1 mbpd could come on stream just by going back to pre-embargo production levels. Saudi Arabia will not want to (and cannot afford to) accommodate all the production increase in the outside world and inside OPEC. The OPEC cartel could fall apart, for practical purposes.

If our assumptions above are correct, then oil prices would average lower by the early 2020s than in the past few years. High marginal cost producers would eventually be priced out, and cheaper unconventional oil (with a marginal cost of maybe around $60/bbl) would displace some of them.

We have not seen the last of the Arab Spring![riot-opposition-tear-protest.si[1].jpg](http://m.cdn.blog.hu/gu/gurulohordo/image/riot-opposition-tear-protest.si%5B1%5D.jpg) Source: rt.com

Source: rt.com

Of course a lot depends on whether the unconventional oil revolution is for real, and we cannot be certain of that yet. And the adjustment would not happen in a straight line. A lot of countries got used to high oil incomes in the past few years, as reflected in rising break-even oil prices needed to balance their budgets. Lower incomes could well lead to unrest or revolutions, and thus oil supply disruptions. That could push up the price again, but only for a while. New regimes would need the oil revenues as well, and would hurry to re-start or continue production. Only in the case of a sustained civil war (á la Syria) or an isolationist regime (á la Iran) would there be a lasting impact on production. We expect that most of the political change in oil-producing countries will instead be the Libyan type: maybe a serious disruption in the short run, but followed by a quick recovery. Too much money is on the table, even with potentially lower oil prices…

Higher volatility, but lower oil prices

Of course even “small” disruptions can add up to a couple of million barrels per day. And even a chance of a disruption in Saudi Arabia would catapult prices in the short run. So oil price volatility is almost guaranteed – we could even see price spikes to record highs. But the underlying fundamentals are slowly shifting towards lower average prices. That would increase consumption – maybe those 1.5 mbpd demand growth predictions will turn out to be correct after all – but not the way most forecasters imagine it at the moment…

If you liked the post, follow Barrelperday on Facebook!

Or subscribe to our Twitter feed or Newsletter

Tags: gas, MidEast, oil, OPEC, Saudi Arabia

No comments yet