This is why more Russian gas is a bad idea

28 Nov

The price of natural gas is higher in European countries where the share of Russian import is high. Most likely this is not because of import dependency, but Russian dependency. While many countries import gas into their country, which is a healthy trade helping both the countries involved in the process, one of the main problems of this is the leaky pipelines which although can be detected by using a Portable Gas Detectors, but resolving this issue will again cost the country a ton of money. If Eastern European countries want to buy cheap gas, they need to connect to the Western-European gas market: there Russian gas has to compete with other sources, leading to much lower prices.

By Csaba Pogonyi, Péter Simon Vargha and István Zsoldos. This post first appeared in Hungarian on the Defacto blog.

How can Central and Eastern European countries get cheaper natural gas? First it may sound reasonable to be on good terms with their biggest provider, Russia, and try to achieve a good deal with them. Or is it? To check this, we took a look at natural gas prices in the EU: how does import dependency and dependency on Russian gas in particular affect gas prices?

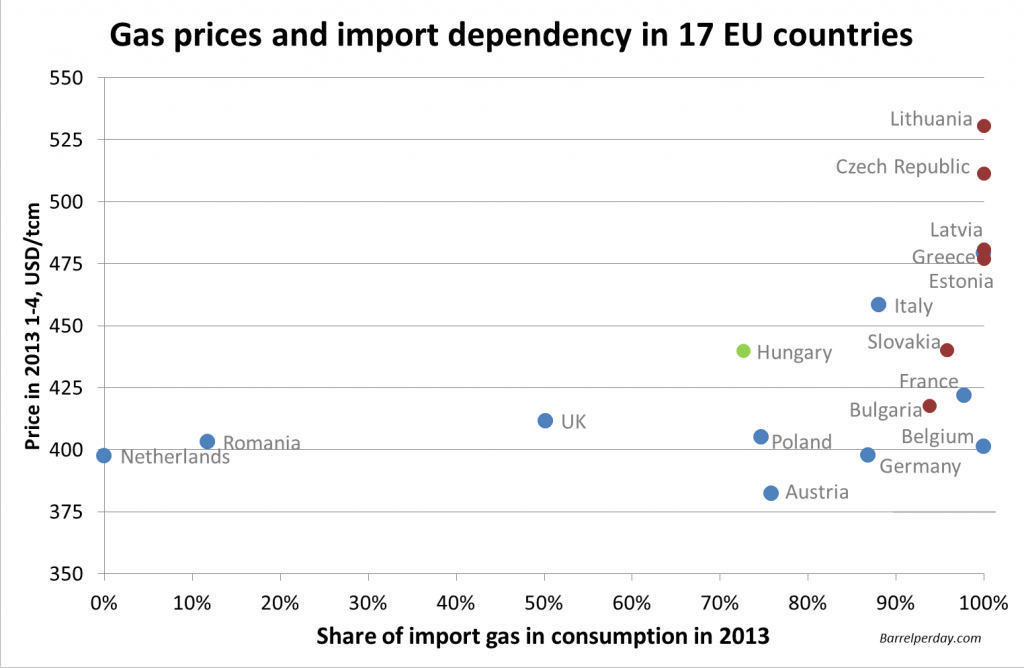

For 17 EU countries, the first chart shows import dependency and gas prices: the horizontal axis shows the share of import in gas consumption, and the vertical axis shows the wholesale price during the first 4 months of 2013.

Sources: price: European Commission, import gas: Gazpromexport, consumption: Eurostat, own calculations. Gas prices are either local gas hub prices or the price of Russian gas. For countries not present on the chart we could not find reliable data.

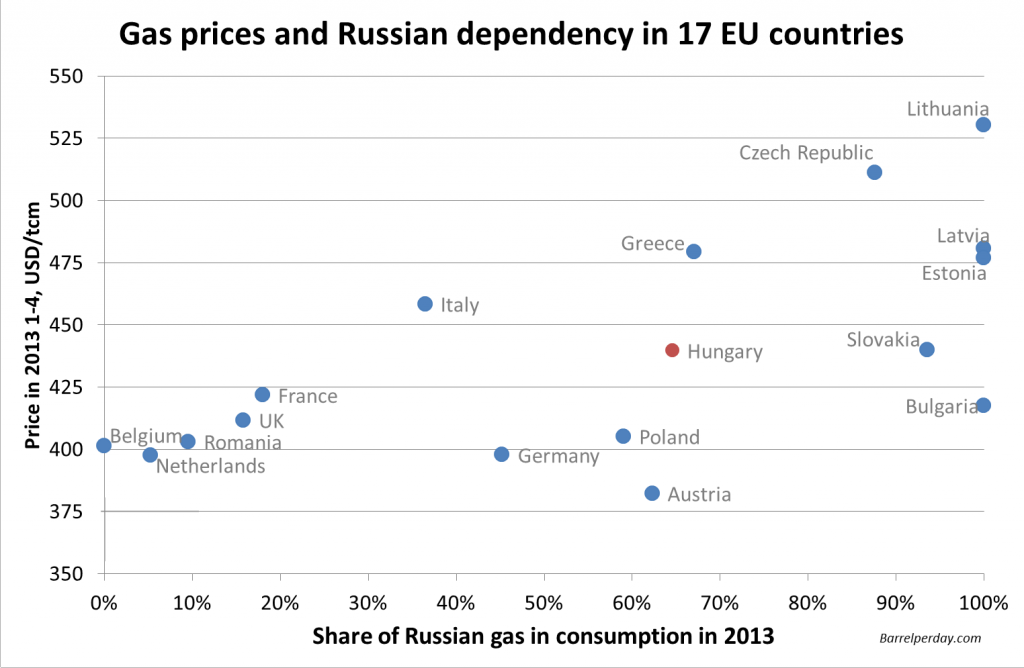

The chart shows that the price of gas was increasing with the share of Russian gas in consumption in 2013. Belgium did not buy Russian gas at all and they paid $401 per thousand cubic meter (tcm). In comparison, Latvia bought 100% of their gas from Russia, and they paid $531 – 32% more. Hungary is in the middle: 65% of consumption came from Russia and the price was $440/tcm.

There can be two explanations for this phenomenon: it is possible that Russia-dependent countries have no access to other sources. This way, the dominant Russian exporter can exploit its position and charge a high price. The other possibility is that it is not Russian-dependency that matters, but import dependence in general. In this case, countries on the right of the chart pay a high price due to their import dependency.

Which explanation is more likely? To shed light on this, our second chart shows the connection between prices and net import dependency.

Sources: price: European Commission, import and consumption: Eurostat, own calculations. Gas prices are either local gas hub prices or the price of Russian gas. For countries not present on the chart we could not find reliable data.

Here the correlation is much weaker. There are a lot of countries on the lower right corner of the chart (Austria, Germany, Belgium): these countries pay a low price in spite of high import share. Moreover, among highly import-dependent countries, those which had 80+% Russian import (red dots on the chart) paid the highest prices. Thus, this chart suggests that it is not import-dependency per se that leads to higher gas prices, but dependency on Russian gas.

How can Central and Eastern European countries achieve a cheaper gas bill? These two charts suggest that not by strengthening ties with Russia, but by building more connections towards alternative gas sources, which compete with Russian gas. To achieve this, the region does not need grandiose pipelines spanning continents. The Nabucco plan was politically risky and would not have added much to the overall European supply. And the South Stream would only bring the same old Russian gas to the region.

CEE should rather build the pipelines that connect to neighbouring countries, so the cheaper Western European gas could flow into the region. A good example is the Slovak-Hungarian interconnector, which will be operational from January 2015. It will help to link Hungary with the Austrian-German market and will be able to transport 5 billion m3 gas yearly, which is currently more than half of total Hungarian consumption. (This is not visible on the chart; however, Slovakian prices dropped significantly in the last two years, likely due to Western competition to Russian gas).

It is not necessary to swap Russian import completely: the mere possibility of buying gas from other sources can be enough to make Russians lower their prices. It is crucial though, that the EU enforces its principles on energy and competition policy. For example, every trader must be allowed to resell its gas and transparent access to pipelines has to be ensured.

The price of import gas and lowering household utility bills

By decreasing the regulated price of natural gas for households, a government does not change the price of import gas. This merely an internal redistribution: consumers pay less, but that burden is borne by industrial users and gas utilities. Lowering prices may even have a detrimental effect on total spending in the long run: if the population spends less on insulation, window replacement and other energy saving investments, natural gas consumption stays high. For example, household gas consumption per m2 in Hungary is currently almost twice as high as the EU average.

The Barrelperday blog (and Defacto) argues that if Central and Eastern Europe and Hungary in particular aims to reduce the price of natural gas in the long run, it should enhance market competition by diversifying among import choices.

If you liked the post, follow Barrelperday on Facebook!

Or subscribe to our Twitter feed or Newsletter

No comments yet