LNG ante portas: Growing LNG penetration in Europe

20 Oct

In the previous post we highlighted that a significant oversupply is building up in international LNG markets, and suppliers have to find new markets as Asia seems to get satiated with LNG. In the longer run, we expect new markets to emerge while the deployment of LNG in transportation will become more widespread. However, in the next few years LNG can be sold only at those markets where infrastructure has already been installed to regasify and distribute LNG to consumers. Therefore, many free LNG cargos will head towards the European markets. In this post we examine to what extent LNG will be able to penetrate the competitive European gas markets and how market conditions will change as a result of the intensified international competition.

Europe hosts the quarter of global regasification capacities

The first LNG tanker arrived in Europe in 1969. Firstly, LNG penetrated those large markets that were remote and less accessible for large pipeline suppliers: Spain, south of France, south of Italy. In this first period, LNG contracts mirrored the conditions of the Russian oil index LTCs. From the early 2000s the business model of LNG transportation has changed. New terminals were built without long-term contracts in the Netherlands and in the UK. They primarily berth spot cargos that are sold at market prices. In the eastern part of the continent two smaller regasification terminals were built in Greece and Lithuania. The total European regasification capacity amounts currently to 200 bcm, more than the annual pipeline import capacity from Russia.

LNG terminals in Europe

Source: GIE LNG terminals in Europe. Operational and under construction terminals can be considered as firm capacity, several planned ones might not materialize.

Source: GIE LNG terminals in Europe. Operational and under construction terminals can be considered as firm capacity, several planned ones might not materialize.

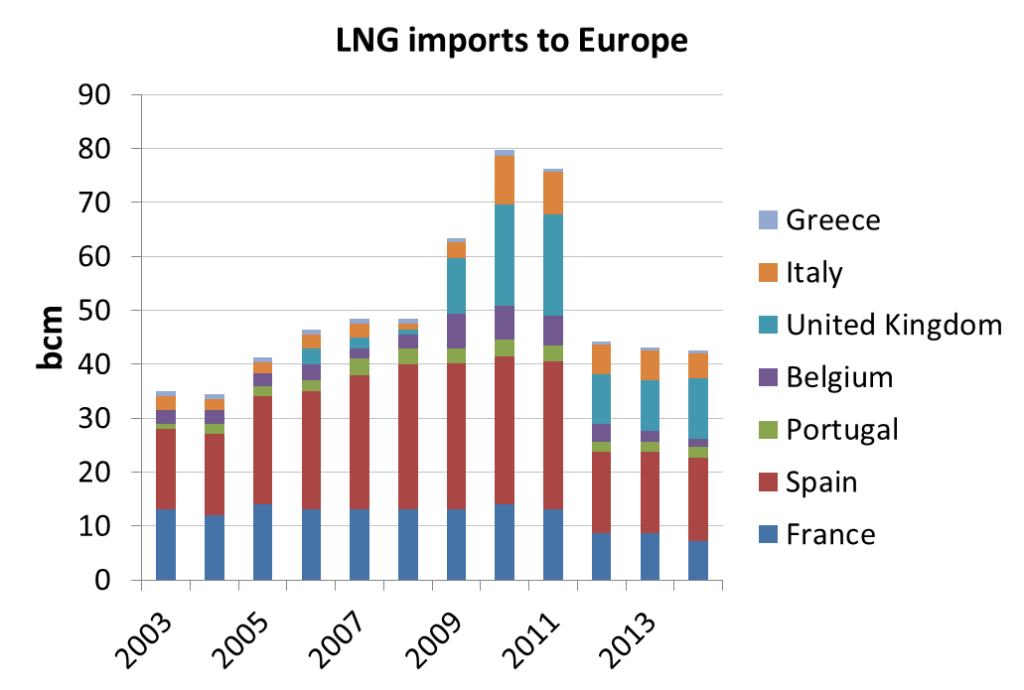

After Fukushima LNG got overpriced for Europe

Up until 2011, market share of LNG expanded slowly but continuously. At the peak it reached 50% of Russian imports. However, the Fukushima nuclear disaster prompted a 40 bcm additional LNG demand by Japanese and South Korean power plants, which resulted in the doubling of Asian LNG prices. High prices diverted all flexible supplies to the region: spot cargos bypassed the European markets, and the flexible part of the European contracted volumes was also redirected towards the Far East. (See our previous post on the structure of the LNG market).

It was surprising how easily the European gas markets accommodated to the halving of LNG supply. Although spot prices increased to some extent, they remained below the oil indexed contractual prices. Low gas prices reflected clearly that there was no supply scarcity: demand was so low in the years after the financial crisis that Russian contract-based deliveries were cut back to the take-or pay minimum, while pipeline capacity remained flexible.

Cheap LNG to conquer Europe again

In our previous post we reviewed the sluggish response of the LNG supply after Fukushima. As a belated reaction to the accelerated Asian demand growth, there will be a 50% supply growth in the next five years. Growing supply started to ease market conditions: the Asian price premium has vanished and the non-contracted volumes have been steadily increasing. As Europe is equipped with the necessary infrastructure and several liquid gas hubs are in operation with high turnover, it will become a key destination for LNG cargos searching for end users.

The big question is to whom and at what price the incoming LNG will be sold. It is a competitive market, where European producers and traditional importers will try to defend their markets: there is abundant export capacity in Russia and their deliveries are still lower than the pre-crisis level by 10 percent.

The indigenous European production is gradually declining that might open a 20-40 bcm gap for new imports in the next 5 years, depending on the gas prices. However, on the short run pipeline and LNG importers have to compete for market share. The take-or-pay volumes from long-term contracts are firm deliveries. Consequently, only spot volumes and the flexible part of the long-term contracts can be taken over by new LNG supplies. However, gas traders prefer LNG only if it is competitively priced compared to the – today only partially – oil-indexed contract price and with the spot wholesale price. Therefore, one can expect that spot LNG cargos will be sold at TTF price and longer term contracts will more likely be indexed to hub prices than to oil prices.

As the European hub prices depend on the supplied volumes, increasing market penetration of LNG might be accompanied with a prolonged period of low gas prices. If LNG and pipeline gas will continuously compete with each other for market share, a downward price spiral might develop. Final market prices will depend on whether Gazprom pursues a profit-maximization or a volumetric/market share maximization pricing strategy. In case of market share targeting, gas prices might fall to the short-run marginal costs of LNG (USD 120-130 USD/1000m3, depending on US Henry Hub prices). However, it is more feasible that Gazprom’s optimal price will be higher: it is enough if the price prevents new LNG investments and hinder some new North Sea gas field developments to break even.

Source: own calculations based on MIT cost model

Source: own calculations based on MIT cost model

Lower gas prices might boost European gas demand, if it makes the currently idle gas power plants competitive again. In the last five years, gas-based power generation plummeted in Europe: subsidized renewables and cheap coal-based generation plants squeezed their market share. As the plants are still operational, in case of lower gas prices (or higher, pre-crisis CO2 prices) the gas demand in power generation can ramp up swiftly. At European level, 30-40 bcm extra gas demand might be created solely by power plants. However, coal-to-gas substitution in Europe requires a further 20-25 percent price decrease, assuming no tightening in CO2 policy and no further decline in coal prices. It is important to note, that the assumption on coal prices is rather fragile, as gas and coal are close substitutes and low gas prices might dump international coal prices as well, as it happened when American shale gas appeared on the market.

To summarize, we expect European LNG prices to fluctuate in the range between Russian gas prices at the top and the coal-to gas switching at the bottom in the period of forthcoming global LNG surplus (170 and 240 USD/1000 m3). In the next post we will continue our analysis with a regional focus: what will be the impact of cheap LNG in the landlocked Central and Eastern European region.

If you liked the post, follow Barrelperday on Facebook!

Or subscribe to our Twitter feed or Newsletter

Tags: coal, electricity, EU, gas, LNG

No comments yet