Does the IEA’s new World Energy Outlook miss the global transition?

26 Nov

The energy transition from fossil fuels to renewables will likely be faster than the International Energy Agency predicts in its recent World Energy Outlook. We are at a point when renewables are getting cheaper than fossil fuels in many areas, and that means a whole different game.

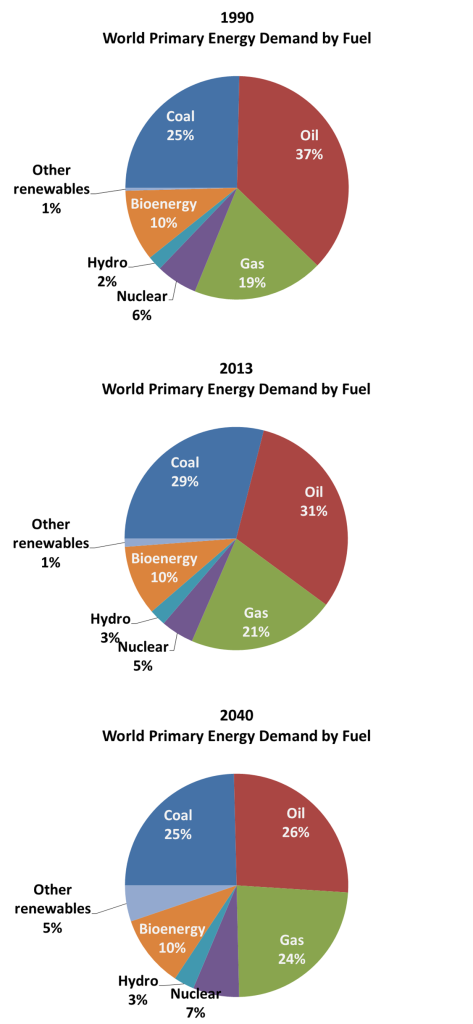

The IEA’s regular World Energy Outlook (WEO) is everybody’s turn-to guide of the present and future of the global energy markets. However, looking at their Outlooks year after year one might be tempted to think that not much is actually changing in the energy sector. What do I mean by that? Take a look at the following charts, showing the shares of global energy demand by fuel in 1990, 2013 (the most recent available) and 2040 (in the New Policies Scenario, the ‘central scenario’ of the WEO).

Yes, the pie is getting ever bigger, but the changes in the mix are arguably not that big. Oil has been losing share and will continue to do so. Fossil fuels accounted for over/around 3/4th of total energy and IEA thinks that will be the case still in 2040. IEA forecasts coal’s share to be the same in 2040 as in 1990, while oil declines somewhat and natural gas makes some gains.

Meanwhile, solar and wind (these are called ‘Other renewables’) increase from the current 1% to only 5% share in 2040 and will still be a smaller piece of the pie than nuclear – at least according to the IEA’s view.

The IEA seems too pessimistic

I think these forecasts are way too pessimistic about the spread of renewables. Solar and wind energy costs have dropped significantly so that soon they may be cheaper than fossil-based generation. The IEA still does not seem to incorporate that tipping point in its central forecasts.

To give a hint why I think this is likely to be the case, take a look at the following chart, which shows the evolution of the share of renewables in electricity capacity additions compared to IEA’s forecasts.

IEA in fact forecasts LOWER share of renewables in added capacities over the next decade than in recent years, even though the need to subsidize these has fallen rapidly as installation costs collapsed.

IEA thus appears to be rather pessimistic about renewables compared to the current trends. This has been the case in the past years, too: they have had to revise their forecasts upwards each year. (And not just the forecasts, their current cost estimates also appear to be pessimistic. See also vox.com on a number of potential reasons.)

IEA’s scenario could probably materialize if for some reason renewables were stuck, for example if their costs abruptly stopped declining.

Previous examples: yes, transition is slow, but not THAT slow

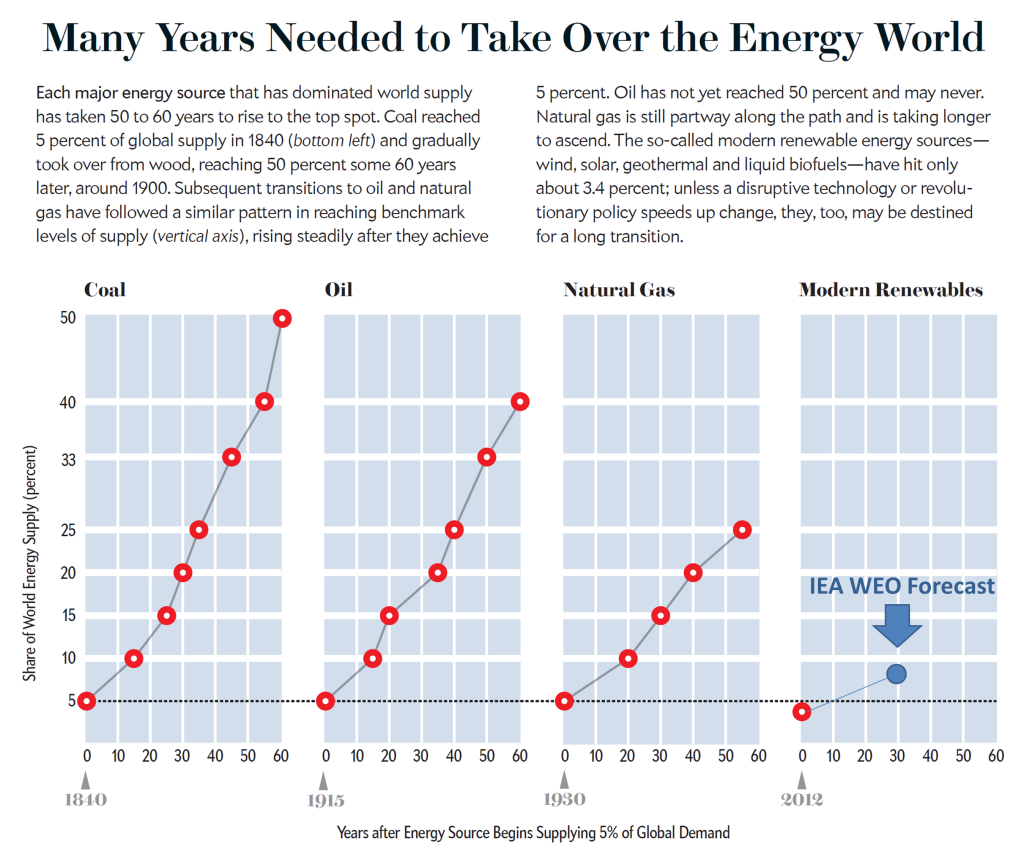

Ok, so will solar and wind energy become dominant in a few years in energy demand? Of course not. As Vaclav Smil has argued convincingly (see e.g. this Scientific American piece), such transitions are generally slow, because energy investments are capital intensive – we need a large new infrastructure to supply it.

Smil has also collected global data on previous examples when such transitions happened, in the case of coal, oil and gas. The chart below shows how new technologies fared once they reached around 5 percent share. In thirty years, each surpassed 15% share. Meanwhile the IEA’s forecast puts modern renewables below 10% in 2040, so around the 30 years mark (I added this to Smil’s chart below, too). So this also suggests that IEA’s forecasts are rather pessimistic.

Source: Smil (2012) and IEA

The market for electricity generation is already saturated in rich countries, where they have built up their fossil fuel capacity and the necessary grid infrastructure to transport power. Replacement of power plants happens only very slowly. However, the bulk of new demand will come from emerging countries, where production capacities need to increase significantly. Moreover, with solar and wind, some emerging countries can save by investing less into large transmission infrastructure as power is generated and consumed locally. Therefore, emerging markets hold the key for the transition. Emerging markets have recently started to outspend rich countries in clean energy investments.

Is India really the new China?

An interesting change in this year’s WEO is the change in the geographic composition of assumed energy consumption growth. China’s economy has slowed, and probably growth there will be much less energy intensive and much less coal-intensive – this is also reflected in the IEA’s forecasts.

So you would probably think that the IEA has significantly lowered global coal demand forecasts compared to previous years (China currently consumes more than 50% of world coal production, so a decline in that would have an impact on global numbers as well). Well, you would be wrong.

Meanwhile, IEA has significantly increased India’s coal demand projections, by a whopping 22% by 2040, compared to last year’s outlook! So they say that India would be a new China, not just in the sense that its energy consumption would increase, but also in its composition: its growth would be very coal-intensive.

The IEA projects coal’s share in India to increase until 2040 and renewables (other than hydro and bioenergy) to cover a mere 3% of primary energy demand.

Will this be the case? Unlikely. Because of the renewables cost decline, increasing power from renewables seems like a better bet than coal. In case you have not noticed, India is very sunny. And solar power may be cheaper than electricity generated from coal there by as early as 2020, according to a KPMG study.

Solar power might be cheaper than coal in India from 2020. Source: KPMG, via Quartz

Also, major Indian cities are already even more polluted than Chinese ones. As India gets richer, this is likely to be more of a constraint in a democracy than in China.

Moreover, distributed renewables backed up by batteries (which also see significant cost declines) might require less investment into the grid, thus they might be favored in emerging economies, including India.

Thus many emerging economies, including India, will probably leapfrog from an underdeveloped system to one where solar and wind-based power generation plays a larger role. A similar leapfrogging happened in mobile technology: instead of wired infrastructure, most people in Africa and India now use mobiles.

If you liked the post, follow Barrelperday on Facebook!

Or subscribe to our Twitter feed or Newsletter

Tags: China, coal, energy transition, IEA, India, renewables, solar

Forecasters always get big transitions wrong. Nobody got a 30 dollar oil price until it had been falling for a while.

There will be an inflexion at some point (in investments) which over a period of a couple of decades will have a big impact on overall percentages.

We don’t know exactly when it will happen, but at least we could be reasonably sure that it happens well before 2040

The IEA’s projection of coal for 2040 seems ridiculous. Coal is rapidly declining in many different energy sectors as prices for natural gas remain cheaper and more economically feasible, not to mention the cheap price of renewable energies such as solar and wind. We may see a transition much sooner than forecasted, especially in the case of the coal industry.