Will the cheap US gas be exported?

19 Jun

The US chemical industry would rather export the natural gas in the form of plastics, the greens would not export it at all, and the foreign policy lobby regards gas exports as a tactical weapon against the Russians. The jury on exports is still out, literally.

![]() By András Bácsi-Nagy. András has recently joined MOL Group; formerly he worked at the Embassy of Hungary in Washington, D. C.

By András Bácsi-Nagy. András has recently joined MOL Group; formerly he worked at the Embassy of Hungary in Washington, D. C.

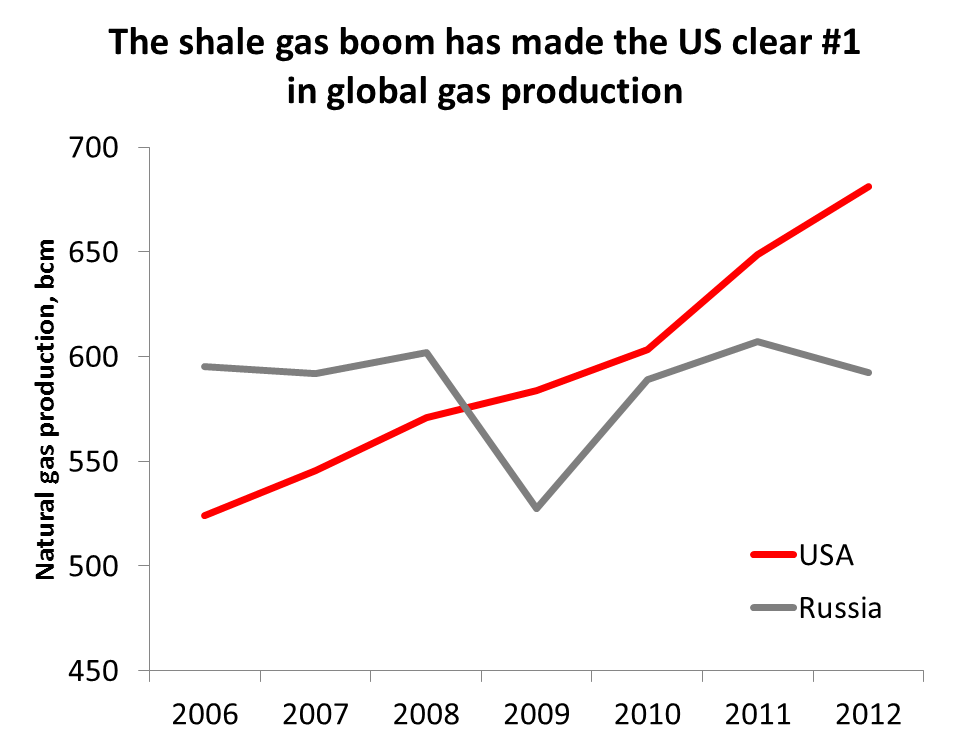

You must have been living under a rock if you have not heard about the US shale gas revolution, which is transforming the natural gas map of the US and the global energy landscape before our very eyes. This is currently the biggest story in the energy world and may be eclipsed only by the US tight oil revolution. You only have to think of the fact that the volumes of natural gas that are not imported into the US are now looking for markets elsewhere, adding to the global supply.

Plenty of shale gas to export from. Data source: BP

Plenty of shale gas to export from. Data source: BP

US gas exports: many would be keen to buy

One of the more popular topics of the past couple of years has been the possible export, in liquid form (LNG), of surplus US natural gas. Foreign governments are mostly optimistic about the imminence of receiving US gas. This optimism may be well-founded in the case of Asian countries, such as Japan and South Korea, since regional prices in Asia are high enough so that exports remain competitive even after the costs of liquefaction, transportation, regasification, as well as trading margins, are factored in. But is this equally true for Europe, where prices are somewhere between those in the US and Asia, and where the predicted upward correction of US domestic prices may change the equation? Will the receiving terminals of Swinoujscie in Poland (under construction) and the one planned for the Croatian island of Krk receive natural gas from the US?

The hurdles are not only economic but – at least for now – also political and legal. Under current US law, the export of natural gas (as well as that of oil) requires a license. When ruling on applications, the US Department of Energy (DOE) must decide whether the export is “in the public interest.” The law, however, presumes it to be in the public interest unless a serious case to the contrary can be established. For projects that seek to export to countries that have concluded a free-trade agreement (FTA) with the US, the permit is granted automatically and without delay in the case of most FTA countries.

Obama’s new Energy Secretary, Ernest Moniz and head of EPA, Gina McCarthy. Forrás: latimes.com

Obama’s new Energy Secretary, Ernest Moniz and head of EPA, Gina McCarthy. Forrás: latimes.com

Public interest is examined from a number of angles and based on a set of non-statutory economic and political criteria, taking into account, among other things, the security of US natural gas and energy supply, as well as the macroeconomic, environmental and geopolitical impacts of such export.

Fierce lobbying in the background

Yet the situation is not as simple as that. Since the export of natural gas has only been a theoretical possibility up till now, the DOE has not been forced to take precedent-setting decisions regarding this delicate issue. The ramping up of natural gas production has now put bureaucrats under political pressure. One the one hand, foreign – especially Asian – governments and companies, as well as would-be US exporters, are beating a path to the door of US decision-makers, lobbying the DOE to speed up the granting of export licenses. On the other, US companies – led by the chemical giant Dow – whose competitiveness has rebounded thanks to cheap shale gas, as well as green activists, are against the wholesale opening of exports. (Their arguments are gaining traction with some politicians despite the fact that the oft-cited “onshoring” of jobs remains elusive.) The debate will probably end in a compromise that allows for some LNG exports, thus spurring the drilling of more shale wells, but will limit the exportable volumes to protect US industry. (This is also suggested by the fact that Obama seems to support gas exports for a number of reasons.)

In preparation for its decisions, the DOE commissioned its in-house think-tank, the Energy Information Agency (EIA), as well as the economic consulting firm NERA, to analyze the macroeconomic and global impact of LNG exports from the US. Both studies have concluded that the export of American LNG will lead to a modest rise in domestic prices but – according to NERA – the overall economic benefits of the exports outweigh the downside. (Of course, households are not likely to be comforted by the growth in GDP when they see their utility bills go up.)

The studies were open to public comment until the end of January, and the comments show how polarized the issue has become. The most important fault line lies not between market-friendly Republicans and state-interventionist Democrats, as might be expected, but between chemical companies wary of losing their competitive edge and energy companies, as well as their political supporters on both sides. Among the arguments you will find (on the “pro” side) job creation; the reduction of the trade deficit and greenhouse gas emissions; as well as the need to benefit from this comparative advantage in short order. On the “con” side you will hear about the loss of competitiveness and jobs, the end of the dream to achieve energy independence, as well as the need to take into account the interest of households and the environmental dangers of shale production.

Tactical weapon against the Russians?

There are at least two other important arguments for LNG exports. One is moral (it is right to help our allies through exports) and the other geopolitical (exports of LNG increase allies’ security to the extent it allows them to ease their dependence on Russian gas). These arguments are advanced by Congressman Mike Turner (R-OH) in his bill entitled “Expedited LNG for American Allies Act,” which aims to bring NATO members and Japan to the level of FTA countries as far as LNG exports are concerned.

Though the bill faces an uphill struggle in the House, and its supporters’ motivation is at least partly suspect (they mostly come from states where energy companies have strong lobbying presence), it is a gesture worth applauding. In countries that have historical reasons to fear the Russian bear – but also on simple grounds of supply security – such thinking is, naturally, welcome from these Congressmen. Let’s look at the realities, however.

Long line to get export licenses

There are currently 18 applications for natural gas export pending before the DOE, for a total of 295 billions of cubic meters per year (bcmpa). Only two have been approved – conditionally – for a maximum of 36 bcmpa of natural gas. (In comparison, the total annual natural gas production of the US is 834 bcm; consumption is 710 bcm. Hungary consumes around 10 bcmpa, and the full capacity of the Nabucco pipeline – if it is ever built – would be 31 bcmpa.) It is not difficult to predict that not all terminals will see the light of day. The enormity of capital expenditure needs (we are talking about billions of dollars), the length of the return on capital (around 20 years) as well as the difficulties in financing will weed out the non-viable. Among the nine terminals that are thought to have the best chance of being built only two are on the West Coast; the ones in the Gulf of Mexico and the East Coast can however only export commercially to Asia after the expansion of the Panama Canal is completed, in 2015.

The line to get export licenses is long . Forrás: ferc.gov

The line to get export licenses is long . Forrás: ferc.gov

The terminals with already-approved export licenses will take a couple of years to build, the next generation even more – and in the meantime supply and demand might shift on the global market in unpredictable ways. US natural gas prices have also risen in the past year, and a further increase is foreseen, while LNG from other sources (e.g., from West Africa) might also appear on the market. And the DOE is in no rush to approve applications.

Oil prices are also of some import, since the demand for natural gas is at least partially affected by them. The higher global oil prices are the more attractive natural gas becomes as an alternative. It is difficult to predict, then, the environment in which US shale gas will reach the global market – even more difficult to say with any certainty whether it will reach Central European shores. But the fact that the possibility is there is in itself a warning how quickly the world can change – and how difficult it is for experts (especially for experts?) to prepare for the black swans that determine the course of history, including ours.

If you liked the post, follow Barrelperday on Facebook!

Or subscribe to our Twitter feed or Newsletter

No comments yet